Virtual Asset Money Laundering: A New Era of Financial Crime Requires a New Line of Defense

- Nominis Intelligence Unit

- 3 days ago

- 3 min read

As the global financial system evolves to include digital assets, a new breed of illicit finance has emerged: Virtual Asset Money Laundering (VAML). Unlike traditional money laundering, which relies on complex networks of banks, shell companies, and intermediaries, VAML exploits the speed, automation, and opacity of blockchain infrastructure to obscure the origin of funds in minutes, not months.

The rise of decentralized finance (DeFi), programmable assets, and pseudonymous transactions has created powerful tools for financial freedom, but also for abuse. Criminals no longer need a network of complicit banks; they need a few smart contracts and time on-chain.

Why VAML Is Different

What makes VAML particularly dangerous is its programmability. Through DeFi protocols, bad actors can script the movement, swapping, and mixing of stolen or illicit funds across dozens of wallets and protocols, all in an instant. This process, traditionally known as “layering”, has gone from a manual, trackable process to a high-speed, automated mechanism that can evade detection without ever leaving the blockchain.

Moreover, the use of cross-chain bridges, DEXs (decentralized exchanges), privacy protocols, and mixers gives criminals a toolbox that’s faster and more effective than traditional laundering methods. The entire process can be completed without ever interacting with a centralized entity.

The Role of Kill Switches in Prevention

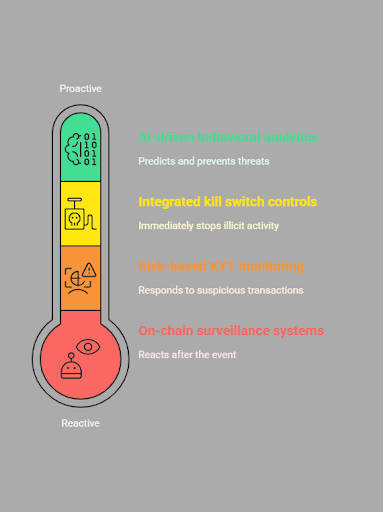

One of the most effective responses to VAML has come from stablecoin issuers like Tether (USDT) and Circle (USDC), who have built kill switch functionality into their tokens. These mechanisms allow issuers to freeze or disable tokens that are linked to fraud, hacks, or sanctions, even after they've been moved to a new wallet.

This ability to lock compromised funds at the token level has proven crucial in major exploit events. In some high-profile hacks, quick action by stablecoin providers helped recover or neutralize stolen assets before they could be fully laundered through the DeFi ecosystem.

While controversial from a decentralization perspective, kill switches are becoming a pragmatic line of defense, especially for regulated assets like stablecoins, which are increasingly used in ransomware payments, exchange breaches, and cross-border illicit finance.

Why Action Can’t Wait

As regulators catch up, the industry must self-regulate now, or risk reputational and regulatory fallout. The speed of VAML means losses can become irreversible before law enforcement or compliance teams have time to react.

Building safeguards… is not just smart, it’s urgent.

There’s no doubt that the power of DeFi and programmable assets opens new doors in finance. But if left unprotected, these same doors can become entry points for organized crime, terrorist financing, and economic destabilization.

Virtual Asset Money Laundering isn’t just an extension of traditional financial crime, it’s a transformation of it. And it requires an equally transformative approach to detection, mitigation, and accountability. By embracing smart surveillance, building ethical controls into token architecture, we can ensure the future of digital finance remains secure, transparent, and trustworthy.

Virtual Asset Money Laundering FAQs:

Q: Can decentralized platforms freeze or block stolen funds like centralized ones can?

No, most decentralized platforms (like DEXs or DeFi lending apps) don’t have the ability to freeze assets, because there’s no central authority controlling them. Once funds move through DeFi, they’re often impossible to recover unless traced early or flagged by external tools.

Q: Are stablecoins more at risk of being used in money laundering?

Yes, stablecoins like USDT and USDC are widely used in laundering schemes because they hold consistent value, are accepted across many platforms, and are easy to swap or move quickly. Their popularity makes them both useful for legal activity and attractive for abuse.

Q: Is it illegal to receive laundered crypto without knowing?

Even if you didn’t know the funds were tied to illegal activity, you could still face consequences, especially if the funds were flagged or frozen later. That’s why businesses use KYT tools to screen wallets and protect themselves from unknowingly handling high-risk crypto.

All research content and accompanying reports are provided for informational purposes only and should not be relied upon as professional advice. Accessing these materials does not create any professional relationship or duty of care. Readers are encouraged to consult appropriately qualified professionals for guidance. We uphold the highest standards of accuracy in all the information we provide. For any questions or feedback, please contact us at contact@nominis.io.