Does the Travel Rule Really Work in Crypto?

- Nominis Intelligence Unit

- 1 day ago

- 3 min read

The Travel Rule, formally known as Recommendation 16 (R16) by the Financial Action Task Force (FATF), has emerged as a focal point in the ongoing debate around regulating digital assets. Originally developed for traditional financial institutions to combat money laundering and terrorist financing, the rule mandates that Virtual Asset Service Providers (VASPs) share personally identifiable information (PII) about the sender and receiver for transactions above a set threshold (typically $1,000 or €1,000). Its application to blockchain and cryptocurrencies raises both operational challenges and philosophical concerns, given the technology’s roots in pseudonymity and decentralisation.

Global Travel Rule Adoption and Compliance Landscape

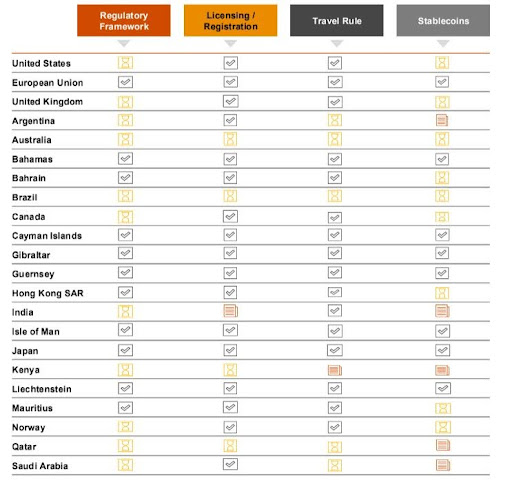

As of 2024, over 128 jurisdictions have formally committed to implementing FATF standards, yet the actual enforcement and implementation of the Travel Rule remains uneven across the globe.

It is estimated that between 500 and 1,000+ Virtual Asset Service Providers (VASPs) are either fully or partially compliant. However, full adherence is largely concentrated in jurisdictions with mature regulatory frameworks.

The European Union and the United Kingdom show high compliance, driven by the enforcement of AMLD5/6 and the Transfer of Funds Regulation (TFR), which became effective in 2024.

In the United States, the FinCEN Travel Rule, introduced in 2020, is technically in place, but compliance levels vary widely across VASPs.

Singapore (MAS) and the United Arab Emirates (FSRA) demonstrate strong regulatory enforcement, with most licensed VASPs meeting compliance requirements.

In contrast, compliance remains low in regions such as Latin America, Africa, and parts of Asia, where regulatory clarity is lacking, technical implementation is limited, and enforcement is weak or non-existent.

Despite growing global attention, only an estimated 20–30% of VASPs are fully compliant worldwide, highlighting the fragmented and inconsistent adoption of the Travel Rule across the crypto industry.

Challenges in Implementation

Imposing the Travel Rule on blockchain-native ecosystems presents several real-world issues:

Is the Travel Rule Benefiting Crypto?

Not yet - at least not meaningfully. The Travel Rule in its current form feels more like an experimental framework than a fully actionable global standard. Adoption is fragmented, enforcement is inconsistent, and its effectiveness remains questionable.

Furthermore, applying the Travel Rule unevenly across borders creates a paradox: what’s the point of enforcing it locally when global peers remain non-compliant? Until there is harmonized global adoption, the rule cannot achieve its intended objective.

One of the most prominent examples of the Travel Rule’s limitations in 2024 was the emergence of the “sunrise issue.” This refers to the regulatory mismatch that occurs when some jurisdictions enforce the Travel Rule while others lag behind. In practice, this created operational bottlenecks—VASPs in compliant regions were unable to transmit the required originator and beneficiary information to counterparts in non-compliant jurisdictions. As a direct result, the percentage of VASPs that began restricting withdrawals to non-compliant entities nearly tripled, rising from 8% to 23% within the year [ according to Notabene Survey] . This breakdown in interoperability illustrates how fragmented implementation not only undermines the effectiveness of the rule but also disrupts legitimate transaction flows and global crypto liquidity.

While the Travel Rule focuses on transmitting identity information, it doesn’t address the actual risk indicators that investigators and compliance professionals track every day:

New clients suddenly transacting large amounts

KYC data mismatched with wallet behavior or email domains

Existing clients moving large sums to clean but unexplained wallets

Wallets lacking a clear source of funds after multiple hops

Unusual logins from unfamiliar IPs, devices, or locations

These are the real red flags - and blockchain analytics tools already offer advanced intelligence to detect such anomalies. In many cases, blockchain-native insights exceed the capabilities of traditional compliance frameworks.

While regulators often believe that increasing compliance rules will eliminate financial crime, illicit activity will always find ways to adapt. The real advantage of blockchain lies in its inherent transparency and traceability. Unlike traditional finance, every transaction leaves an immutable trail.

This gives us, as an industry, the opportunity to develop smarter, more proactive compliance tools - ones that don't just tick regulatory boxes but actually detect and prevent financial crime.

Conclusion

Yes, the Travel Rule matters - but only as part of a broader, more intelligent compliance strategy. It is not a silver bullet, and its current implementation is far from perfect. The focus should now shift toward:

Better analytics and risk detection tools

Interoperability and collaboration across borders

Education and standards for VASPs

The future of crypto compliance will be data-driven, intelligence-led, and globally coordinated - not merely rule-based.